Does your digital roadmap align with the new reality of what your customers demand? As a growing number of financial institutions recognize the value of creating frictionless, consistent customer experiences, more questions arise about how to make the most of every interaction, regardless of engagement channel.

We have had the privilege – for several years now – of working alongside our customers in the financial services sector, innovating and implementing AI-powered solutions that can transform the way we work, connect, and interact with each other. Through these partnerships, we honor our customers by listening to what they have to say, what they need, and most importantly, what consumers need from them. One thing we hear consistently is the importance of improving the customer experience (CX).

Beyond our own conversations and experiences, industry research also bears this out. Forrester’s recently issued digital banking assessment is clear: “To achieve digital mastery,” they write, “banks need to invest in digital capabilities that reflect the entire customer lifecycle and support customers across touchpoints.” Likewise, Deloitte has published content exploring how “customers want more highly personalized experiences that cater to their needs, wants, and expectations.”

In other words, successfully designing and implementing your digital roadmap means aligning your offerings and capabilities with your customers’ journeys. Consider how the global pandemic accelerated consumer adoption of digital banking products such as digital wallets, virtual credit cards, mobile banking, and new types of accounts. At the beginning of 2020, no one could have predicted this significant shift, which not only opened up new opportunities, but also created some challenges.

For example, with new types of customers now accessing online or mobile banking, they have countless questions about these services, how to reset passwords, and even how to access their money without visiting a branch location. More important than simply answering these questions, however, was how each financial institution handled every customer interaction – particularly as customers expect each interaction to be seamless, personalized, timely, relevant, and intuitive. Unfortunately, however, many institutions were unprepared for the influx of new traffic through all the traditional channels (phone, live chat, and email). High contact volumes slowed down service in some cases, and in other cases, made it difficult to prioritize certain customer populations who needed more support than others.

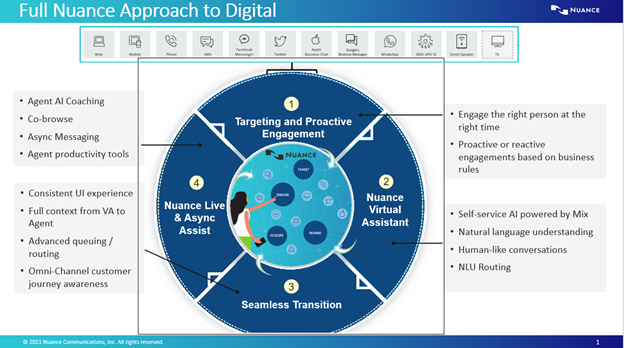

Banks that used asynchronous messaging channels like SMS/Google Business Messages fared better because customers did not have to wait on hold for answers, even when the answer was received after a delay from busy agent teams. This points to the value of adding asynchronous messaging channels (such as SMS, WhatsApp, Google Business Messages, and others) to the channel mix because they can alleviate the burden during busy periods, improve agent productivity, and even support better NPS scores.

AI-powered customer engagement solutions, built purposefully for the financial services sector, can help institutions meet customers’ demands for frictionless, consistent omnichannel experiences while adapting to new digital banking realities. That is, customers are going to have questions about their accounts – there’s no avoiding it. Virtual banking assistant and chatbot (or banking bot) solutions can anticipate and answer customers’ digital banking questions, automating some aspects of customer service while seamlessly connected to live agents when that’s most appropriate. Moreover, a banking bot solution that is quick to deploy and can handle a few dozen FAQs can reduce time to launch down to a few weeks.

Because information can change frequently, training customer service representatives to answer every question quickly and accurately is nearly impossible. Agent AI solutions become invaluable here because they can provide next-best responses and actions in real time so that every agent, even brand-new ones, can provide answers that an experienced, high-performing agent would provide.

Ultimately, financial institutions can modernize and optimize customer experiences in banking, reduce the burden on staff, and prepare for whatever the future might hold. It’s all possible when they rely on AI-powered virtual assistant / chatbot solutions and Agent AI capabilities and offer customer engagement on new messaging channels like SMS / Google Business Messages.

To learn how Nuance can help your organization deliver better digital banking experiences, faster, click here.